FATCA ramps up, and Penny is ready

Industry: Financial Services

The 11.1 release of TKS Solutions' Penny It Works® system will include functionality to support full FATCA (Foreign Account Tax Compliance Act) compliance and reporting.

Mt. Kisco, NY (PRUnderground) March 6th, 2015

The IRS has issued many advisories on FATCA and the significant new reporting responsibilities that it entails for financial institutions, administrators, and funds.

Fortunately, the Arpil, 2015 release of the Penny It Works® fund accounting system contains a wealth of features to greatly reduce the effort required to comply with FATCA.

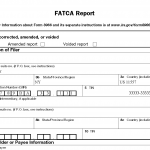

The centerpiece of FATCA reporting in the United States is Form 8966. This form requires classifying investors into their respective FATCA chapter 4 categories, and maintaining extensive investor records.

The latest version of Penny provides the capabilities for designating chapter 4 categories and storing the broad set of investor information needed to complete the form.

In addition, the system offers the capability of providing fund-by-fund information for the investor, for those cases where the reportable information changes from fund-to-fund.

Furthermore, the system can generate the actual pdf for IRS Form 8966 in compliance with the government standards.

Many institutions will want to take advantage of filing electronically through the new IRS International Data Exchange Service (also known as IDES). While electronic filings typically ease the reporting burden, only XML documents that are compliant with the FatcaXML schema are accepted through the IDES gateway. Many who have tried to use the FatcaXML schema have found it very complex because it requires 4 separate “xsd” schema files. Factoring this in, Penny It Works® goes beyond standard Microsoft XML utilities (which are not up to the task of handling such complex schema) and incorporates the advanced XML functionally required to fully comply with the FatcaXML standard.

Many institutions will want to take advantage of filing electronically through the new IRS International Data Exchange Service (also known as IDES). While electronic filings typically ease the reporting burden, only XML documents that are compliant with the FatcaXML schema are accepted through the IDES gateway. Many who have tried to use the FatcaXML schema have found it very complex because it requires 4 separate “xsd” schema files. Factoring this in, Penny It Works® goes beyond standard Microsoft XML utilities (which are not up to the task of handling such complex schema) and incorporates the advanced XML functionally required to fully comply with the FatcaXML standard.

In addition to physical or PDF filing, FATCA regulations require that financial institutions report recalcitrant accounts. These accounts can be pooled into various categories and filed in aggregate. The upcoming release of Penny supports this categorization and as well as aggregated pooling for both Form 8966 and FatcaXML files.

Founder Ron Kashden explains, “We remain dedicated to ensuring that our system is not only the easiest to use in the industry, but also the most complete in terms of functionality to provide real-world support for emerging regulatory requirements.”

Penny’s FATCA functionality is not only broad to cover the wide range of reporting issues, but also deep to improve the entire regulatory compliance process. For example, there are workflow capabilities to allow clients to review the information before any government reporting is produced.The system also automatically highlights any missing required data, which allows information gaps to be addressed efficiently.In the event that omissions or changes occur later in the process, Penny supports the creation of corrected and amendment reports for Form 8966 as well as FatcaXML.

The regulatory environment for the financial industry continues to get more complex. Smart systems, like Penny It Works®, can help ensure compliance, letting financial firms focus on their core businesses.

About TKS Solutions

TKS Solutions is the firm that brings you the acclaimed software, Penny It Works®. TKS is a registered Microsoft partner offering specialized partnership and shareholder accounting solutions for the financial industry. Penny It Works® is used to manage upwards of 9500 onshore and offshore funds with more than $490bn in AUM. The award-winning system provides automated and instant access to detailed investor data, performance, fees, and transactions. Penny’s open architecture facilitates easy integration with portfolio accounting systems, data warehouses and proprietary solutions. Penny is tailored to the specific needs of leading hedge funds, fund of funds, private equity firms, fund administrators and management companies with assets under management ranging from $100 million to $60 billion.